In today’s digital economy, businesses face various challenges when it comes to payment processing. For companies operating in industries with high chargeback rates, fraud risks, or regulatory scrutiny, securing a high-risk merchant account is essential. HighRiskPay.com specializes in providing tailored solutions for such businesses, ensuring seamless transactions, fraud protection, and global support.

This guide explores what high-risk merchant accounts are, why businesses need them, and how HighRiskPay.com stands out as a provider.

What Is a High-Risk Merchant Account?

A high-risk merchant account is a specialized payment processing solution designed for businesses that face higher financial risks due to industry regulations, chargebacks, or fraud concerns. Traditional banks and payment processors often decline applications from such businesses, making high-risk merchant accounts a necessity.

Key Features:

- Higher Processing Fees – Due to increased risk, banks charge higher fees.

- Chargeback Protection – Tools to mitigate financial losses from disputes.

- Rolling Reserves – A percentage of transactions held as security.

- Multi-Currency Support – Essential for global businesses.

- Fraud Prevention Tools – Advanced security measures to protect transactions.

Why Businesses Need a High-Risk Merchant Account

Businesses categorized as high-risk often struggle with payment processing due to frequent chargebacks, fraud risks, and regulatory challenges. Without a high-risk merchant account, they may face account freezes, rejected transactions, or even business closure.

Industries That Require High-Risk Merchant Accounts:

- Adult Entertainment – Subscription-based services, content platforms.

- Online Gaming & Gambling – Casinos, sports betting, lottery services.

- E-cigarettes & Vapes – Regulated products with high chargeback rates.

- Nutraceuticals & Supplements – Health-related products with strict regulations.

- Travel & Ticketing Agencies – High-value transactions with refund risks.

- Cryptocurrency Exchanges – Digital asset trading platforms.

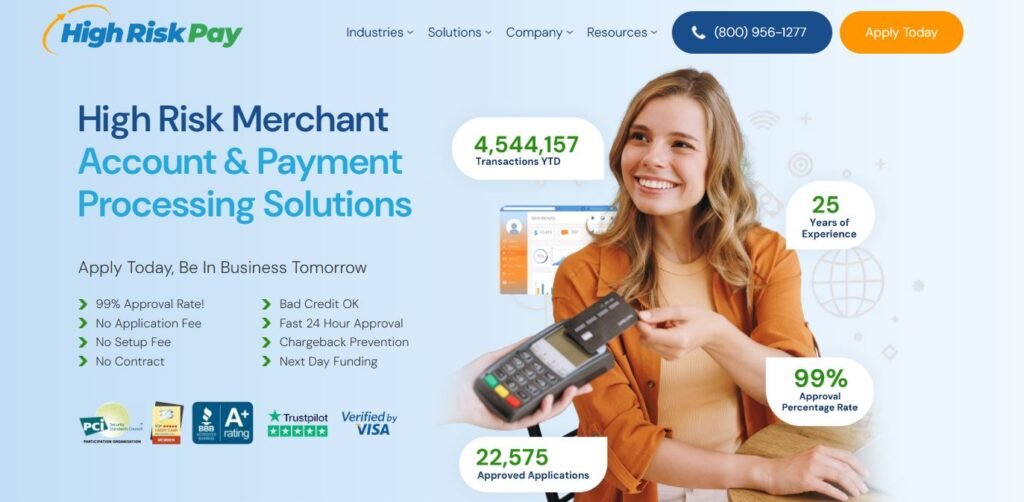

HighRiskPay.com: A Leading Provider

Why Choose HighRiskPay.com?

HighRiskPay.com offers fast approvals, competitive rates, and robust fraud prevention tools. Their expertise in high-risk industries ensures businesses can process payments securely and efficiently.

Benefits of Using HighRiskPay.com:

- 99% Approval Rate – Even for businesses with bad credit.

- No Setup Fees – Transparent pricing with no hidden costs.

- Chargeback Prevention – Tools to minimize financial risks.

- Next-Day Funding – Faster access to processed payments.

- Global Payment Support – Multi-currency processing for international businesses.

How to Apply:

- Collect Basic Information – Business details, contact info.

- Complete the Application – Submit necessary documents.

- Sign via DocuSign – Secure digital signature process.

- Approval in 24-48 Hours – Faster than most competitors.

Comparing HighRiskPay.com with Other Providers

| Feature | HighRiskPay.com | Traditional Banks | Other High-Risk Providers |

|---|---|---|---|

| Approval Rate | 99% | Low | Varies |

| Setup Fees | None | High | Varies |

| Chargeback Protection | Yes | Limited | Varies |

| Fraud Prevention | Advanced | Basic | Varies |

| Multi-Currency Support | Yes | Limited | Yes |

HighRiskPay.com stands out due to its fast approvals, transparent pricing, and specialized tools for high-risk businesses.

Conclusion

For businesses operating in high-risk industries, securing a reliable merchant account is crucial. HighRiskPay.com provides tailored solutions that ensure seamless transactions, fraud protection, and global payment support. With fast approvals, competitive rates, and robust security features, it remains a top choice for high-risk businesses.

If you’re looking for a trusted high-risk merchant account provider, HighRiskPay.com offers the expertise and reliability needed to keep your business running smoothly.